IRR FAQ – Frequently Asked Questions on Internal Rate of Return

Question: Please advise how to calcuALTe the NPV and PV of an amount with interest rate say 6% and inflation rate of 2.5% over a 20 years period. In other words how to incorporate the inflation rate in the PV and NPV formulae.

Answer: Assuming that you put $100 in the bank. And the bank pays you an interest of 6%. If you do not withdraw the amount ($106) at the end of 1 year, the bank will pay you interest of 6% on your $106, i.e. $112.36. If this continues

for 20 years, you would have $320.7135472 in the bank. This is called the future value of $100 at the end of 20 years. To factor in inflation, discount the amount ($320.7135472) by 2.5% (inflation rate). You will get $195.72. That is the present value of $320.7135472. This means that you could buy $195.72 of good and services (non perishable) today and keep them for 20 years, they will be worth $320.7135472 in 20 years time. Deduct the present value ($195.72) from the amount you put in ($100) and you get $95.72. That is Net Present Value, the returns for putting $100 in the bank.

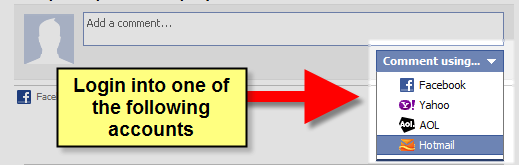

New! Comments

Have your say about what you just read! Leave me a comment in the box below.

Share this page:

Enjoy this page? Please pay it forward. Here’s how…

Would you prefer to share this page with others by linking to it?

- Click on the HTML link code below.

- Copy and paste it, adding a note of your own, into your blog, a Web page, forums, a blog comment, your Facebook account, or anywhere that someone would find this page valuable.

<a href=”http://www.advanced-excel.com/”>Advanced Excel – From a Business Perspective</a><a href=”http://www.advanced-excel.com/”>Advanced Excel – From a Business Perspective</a>

Excel Courses for Business Professionals

Copyright © advanced-excel.com 2007 – 2019. All Rights Reserved. Privacy Policy

Microsoft® and Microsoft Excel® are registered trademarks of Microsoft Corporation.

advanced-excel.com is in no way associated with Microsoft