Why Do Personal Budget Planning

If you think budgeting is not necessary for you, perhaps it’s because you haven’t given it much thought.

Personal Budgeting is more than ensuring you will remain financially sound, be able to manage your finances better and maintain your reserves, it’s projecting where you would like to be in five, ten, or fifteen years, and how you will get there. It’s a rewarding process involving a number of systematic steps that identify your current financial status, the vision for your future (e.g the lifestyle you wish to lead, when you would like to retire), your needs (e.g housing, car, children’s education, insurance), prioritised actions, plans, and monitoring plans as you move along.

Personal budgeting is important for everyone, whether you are single, married, or married with children. Your savings planning and decision process should end with objectives and an action plan to achieve those objectives. A good budgeting exercise puts on you a forward-looking thinking cap and helps you define targets for the short term and long term and tracks implementation systematically. It determines where you would like to be, how you’re going to get there, and how you know if you got there or not. Through an exercise like this, you learn how to bridge the gap between your current financial position and the end desired state through developing and exploring a series of options. Embarking on a personal money planning effort empowers you to take control of your own personal finances and provides you direction and focus for the future.

You can easily create a simple personal plan for your income and expenditure on your own by using Excel. However, effective money management requires more than a simple template. You must be able to

enter your data easily into the template,

insert and delete new items as you go along and

,monitor how well you are following your plan on a monthly, quarter, yearly and even YTD basis.

View your income and spending in different views.

You can do the above usually by buying a software, or apply macros to your excel template. The use of a software or macro further complicates your monitoring of the expenses especially when it fails without you know why. To avoid these problems, we developed a budgeting template using part of a secret excel formula that I taught only in my corporate budgeting course. The template will minimise the frustration you are likely to face using a proprietary budgeting template running on macros or through the use of a program.

Here are some screen shots to show you what you are getting from this template.

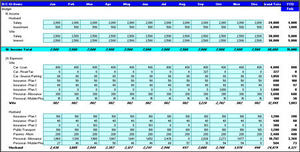

Template to enter your income and expenses

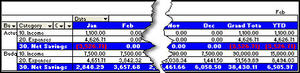

Summarise Income and Expenses.

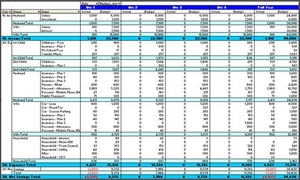

Comparing actual spending against plan on a quarterly basis.

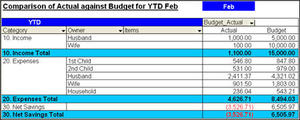

Comparing actual spending against plan on a YTD basis.

Hear what others have to say about budgeting:

|

Do you have a personal budgeting plan? I started with something but lost track along the way. Why you think budgeting is important? It is to help us to achieve the goal we wanted or better still achieve a higher goal in term of saving. It is also a tool to see what the potential problem area is. What is one thing you hope you could do better with your own current budgeting template? It is able to easily manipulate to suit new requirement. Ability to highlight those categories that are over-budget, etc. Anson Ong |

| Do you have a personal budgeting plan? To tell you the truth, I do not have a person budget plan or have not done one in my life. Tried to start something but have not kept up with it. Why do you think budgeting is important? I have now realized that budgeting is a very important tool and process in life that can lead you to live a more realistic meaningful life. What is one thing you hope you could do better with your own current budgeting template? With the current personal budget plan, I hope to make my income and spending more measurable meaningful and live within means. Michael |

|

Do you have a personal budgeting plan? I have, more like a Must, especially during this financial crisis time. With limited income source, I need to watch out my expenditures so that it won’t exceed my income and erode my savings plan. What is one thing you hope you could do better with your own current budgeting template? minimize the absolutely unnecessary expenditures that I obviously can live without, and building up my savings a little bit, step-by-step. Adeline Ong |